|

|

|

|

Lewis &

Co (Financial Management) Limited

Chartered Accountants

Tax accountant Ringwood

Small business accountant in Ringwood, Hampshire & Dorset,

specialising in small businesses dealing with taxation, management and computer advice |

07378 314096

peter@finmgt.co.uk

|

|

|

|

|

Welcome |

|

|

Can I choose how much tax I pay?

No, not if you are an employee, tax is tax and we all have to pay it. If you are self

employed you also cannot choose how much tax you pay, it merely depends on how much you

earn, what your net profits are.

Only a director/shareholder of their own

business gets to choose how much tax they pay by making use of the

different tax rules and regulations. Tax is not only complex but

also various tax and employment laws overlap. A good tax accountant

knows how to make use of the best bits of one set of tax while not

getting penalised by the bad bits of another set of rules.

|

|

|

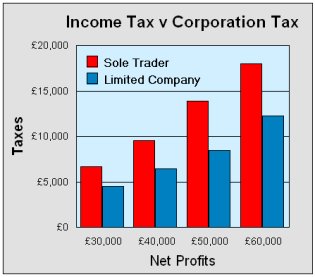

Self employed v limited

companies?

What about the difference between sole

traders, partnerships, limited companies and limited liability

partnerships (LLP's). Which one is more tax efficient?

In most cases, a limited company is

still the best option if your net profits are above £20,000 per

annum. There are also several advantages for higher rate tax payers

because again you can choose how much higher rate tax you want to

pay. A lot depends on your own personal circumstances.

Child Tax Credits and university fees?

What if you have young children or teenagers at university. What about the interaction

between income tax and child tax credits or university funding?

In both cases, how much you can claim in CTC or grants depends on your income. Again,

using a limited company, you can choose what your income is which then determines what

tax credits you get or whether your child can claim a non repayable grant instead of

taking a student loan.

|

| |

|

What else are you looking for from your accountant?

Do you want to know how to improve your profits or do you want to know how to save tax?

The majority of business owners

are mainly interested in saving tax. However, I have experience of

working with many different businesses, construction, engineering,

transport, electronics, retail and consultancy. I know how good

businesses work and also what does not work. I find it is important

to have the right attitude to running your own business and I may be

able to help you by passing on ideas from other successful business

owners.

Want to know more?

I provide specialist tax advice for small businesses, looking at your whole tax

position and taking into account the interaction of the different taxes, corporation

tax, income tax, national insurance, capital gains tax and even the effect of benefits

and allowances such as child tax credits.

I can show you the tax potential of changes to your business setup, for example how

you take money from your business or how you can build up your business value for a

later sale whilst minimising your tax liabilities.

I can also advise you what is legally allowed and what is not regarding tax

and statutory legislation.

I am here to help you save tax while trying to

help you avoid problems before they happen. Sometimes you may just

want to chat over a decision you need to make and you need a second

opinion. Other times it is because I am telling you of tax changes

that might be suitable for you so we need to discuss them

further.

What do you want to discuss?

Call or email me and let us talk about you and your business.

Peter Lewis

| |

|

|

|

How much tax can you save as a limited company? Click here to find out

|

|

Lewis & Co (Financial Management) Limited - Chartered Accountants

Specialising in tax and business advice for small business

Jaspar, Poplar Lane, Bransgore, Christchurch BH23 8JE

|