| |

|

|

| |

Lewis &

Co (Financial Management) Limited

Chartered Accountants

Tax accountant Ringwood

Small business accountant in Ringwood, Hampshire & Dorset,

specialising in small businesses dealing with taxation, management and computer advice |

01425

839727

peter@finmgt.co.uk

|

| |

|

|

| |

Tax

Advice |

|

| |

How can I save tax?

To most businesses, tax is just another

cost that has to be borne just like rent and rates. Just like other

overheads you do have a choice in how much tax you pay.

In the recent tax law

case Artic Systems, the judge concurred

that a business can legitimately conduct their business in

ways to minimise its taxes and thus reduce costs. This is tax

avoidance not tax evasion.

|

|

| |

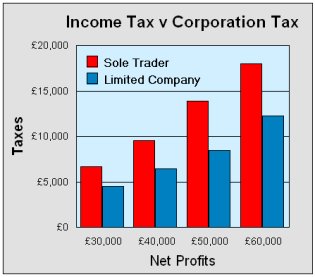

Self employed v limited

companies?

Currently a sole trader or partner has

to pay 9% National Insurance on their net profits above £7,956 per

annum. A limited company does not have to pay National Insurance, it

can but it is not compulsory.

A director shareholder can pay themselves

£7,956 salary and take the remainder of their drawings as dividends.

The next £30,500 can be taken as tax free dividends. The tax

saving at this level is £2,700 each per annum.

Higher rate taxes

If a sole traders profits go above the basic

rate, they have to pay 40% to 45% higher rate Income Tax. A director

shareholder has the option of how much of these extra profits they

want to take and thus pay higher rate tax.

The limited company gives you tax options that are not available to

sole traders or partners.

|

| |

| |

Other tax saving options?

There are legitimate ways to

reduce tax charges on company cars as well as other expenses. There

are options for family run businesses to reduce their overall taxes

and thus preserve more of the business for future generations.

Want to know more?

I provide specialist tax advice for small businesses, looking at your whole tax

position and taking into account the interaction of the different taxes, corporation

tax, income tax, national insurance, capital gains tax and even the effect of benefits

and allowances such as child tax credits.

I can show you the tax potential of changes to your business setup, for example how

you take money from your business or how you can build up your business value for a

later sale whilst minimising your tax liabilities.

I can also advise you what is legally allowed and what is not allowed regarding tax

and statutory legislation.

I am here to help you save tax while trying to

help you avoid problems before they happen. Sometimes you may just

want to chat over a decision you need to make and you need a second

opinion. Other times it is because I am telling you of tax changes

that might be suitable for you so we need to discuss them

further.

What do you want to discuss?

Call or email me and let us talk about you and your business.

Peter Lewis

| |

| |

| |

|

How much tax can you save as a limited company? Click here to find out

|

|

Lewis & Co (Financial Management) Limited - Chartered Accountants

Specialising in tax and business advice for small business

2 Southampton Road, Ringwood BH24 1HY

|